Best practices getting Energetic Funds Application

One of the better practices is to would reveal budget discussing your recovery project’s will cost you. By the meticulously making plans for your expenses, you could potentially ensure that you make use of the loan loans effectively and you will prevent overspending. Likewise, thought acquiring several rates out-of contractors to be certain you get the brand new best value to suit your money.

To avoid Prominent Downfalls

If you are an RBFCU do it yourself loan provide brand new financing you prefer, it’s crucial to prevent preferred problems that will derail your own restoration plans. One common mistake is actually underestimating the entire cost of the project, ultimately causing budget overruns. To stop it, constantly include a barrier on your own budget for unforeseen costs. Another trap to get rid of try racing brand new renovation techniques take the time to browse builders, content, and you will framework choices to make certain you make advised behavior one fall into line along with your vision for your house.

Conclusion

In conclusion, RBFCU do-it-yourself fund was their ticket in order to converting the life area for the a retreat one shows your specific build and you may identification. With aggressive rates, versatile words, and you can a smooth software process, RBFCU stands out while the an established companion of your home upgrade excursion.

So why waiting? Do the next step toward enhancing your residence’s really worth and you can morale with a keen RBFCU home improvement financing today. Whether you’re envisioning a kitchen remodel, toilet change, otherwise lawn retreat, RBFCU is here making the dreams possible. Trust in RBFCU’s assistance and dedication to perfection since you embark on the do-it-yourself enterprise. Help RBFCU be your partner when making home to your own goals.

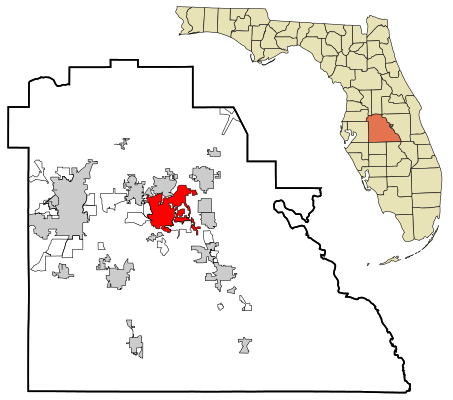

You’ll find credit relationship analysis right here: Bankrate Safe & Voice ™ Lender, Thrift and https://paydayloansconnecticut.com/lordship/ Borrowing Unions rating ability We drawn right up one list of the many of these with thier family offices within the Austin.

RBFCU plus will pay you $0.10 each swipe of one’s debit credit that over often $5 otherwise $10 (I am unable to think about and that). It always results in a beneficial $300-eight hundred search for me personally into the December.

You to definitely virtue you to UFCU provides more than RBFCU is the fact UFCU are an element of the common branch community. This allows one to carry out of several financial transactions in the most other borrowing from the bank unions around the country which might be part of the shared department circle.

If interest levels and/or 100 % free ATMs are essential for your requirements, award checking profile is highly recommended. Numerous Austin neighborhood banking companies and you can borrowing from the bank unions offer these with some providing more than 2.00% apy.

We concur, speaking of often skipped. High-yield checking account is a pretty the type of account. Already this type of short Texas financial institutions have to give the interest prices expressed less than to your higher give examining account, that can come with no service fee’s, free Atm cards and you may Atm use fee refunds for your aside off network ATM’s. They use the fresh fees these types of banking companies gather in the retailers, an such like. to help counterbalance the appeal that they shell out for you new membership manager.

Independent Financial off Colorado, cuatro celebrity rating, Secure dos.38% APY into balance to $25,000 100 % free Benefits Checking | Tx – Texas | Independent Lender

To make one to notice on your account they typically need one you employ their 100 % free Debit card 8-ten moments per month, and set upwards one automatic deposit or debit/payment per month, and you may receive into the-line comments.

Independent Lender try investing step three% ten months ago once i unwrapped a merchant account, he’s because decrease their attention rates twice and are usually today paying dos.38%. Leader Lender is actually the higher deal on 2.76%. I am starting a merchant account with these people soon. Such pricing try each other enourmously top then what you are able get in the Permits regarding Deposit these days.

Leave a Reply