To have people whom actually have a great HELOC set up, using it in order to bridge the credit gap could be more convenient than applying for another connection financing.

The latest varying interest levels from HELOCs is also introduce suspicion in the monthly payments, which might improve in the event the costs go up.

To help you qualify for an excellent HELOC, you prefer substantial equity of your house. This could not easy for group, especially if the property’s value has not liked far.

Having fun with a HELOC to shop for a different sort of home ahead of selling the dated you can end up in overleveraging, in which you owe more than what your characteristics can be worth if the real house business takes an excellent downturn.

A HELOC can also be try to be a bridge financing, but it is crucial that you consider carefully your financial predicament, the actual house industry, and your chance threshold. Consult with a monetary elite that will offer customized advice and help ensure that the choice to utilize a great HELOC given that an effective connection loan aligns together with your total monetary approach.

Compared to the HELOC costs, bridge funds are an even more high priced cure for acquire depending for the rate of interest. Such as, our look discovered that a debtor which qualifies having a HELOC at eight.94% Annual percentage rate may also qualify for a link financing in the 10% Apr.

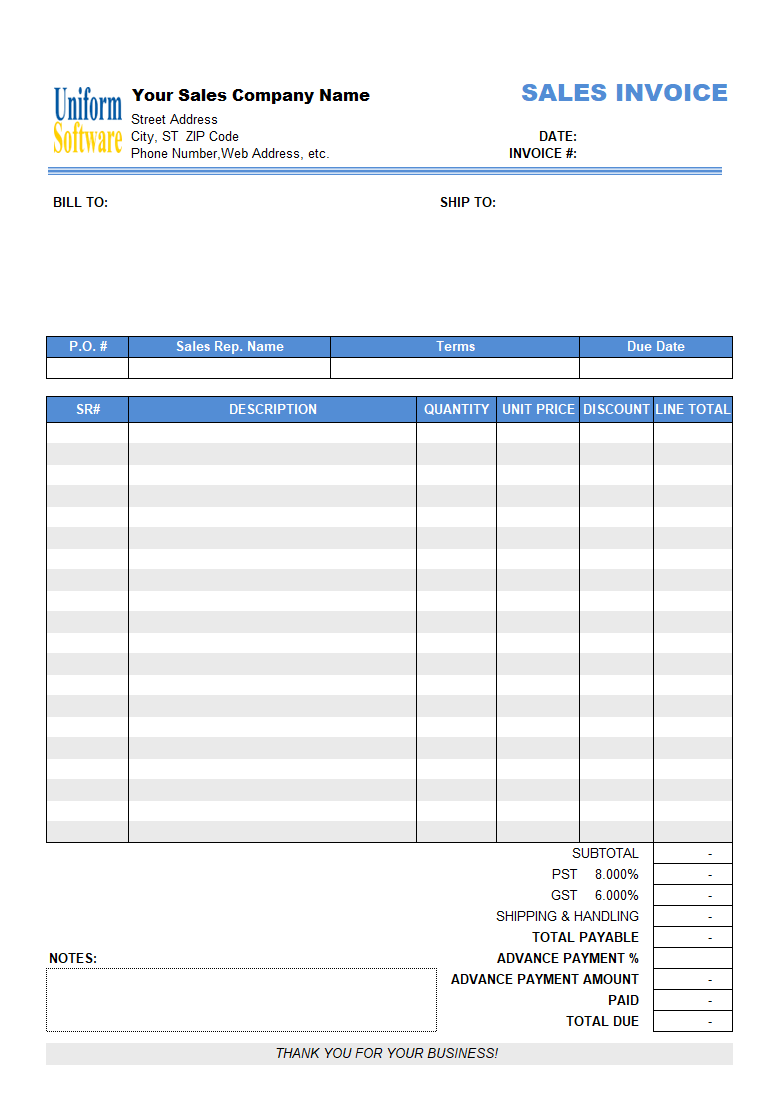

However, as you care able to see on dining table lower than, if you make minimal repayments towards the a good HELOC, you can will pay more during the appeal along the future.

You can pay closing costs with the one another a bridge mortgage and https://paydayloanalabama.com/opp/ you may a beneficial HELOC. An average closure budget range to own mortgage loans is dos% so you’re able to 5% of one’s loan amount. If you get a beneficial $fifty,000 link loan, you might shell out closing costs regarding $1,000 to $2,five-hundred.

- Appraisal fees to select the property’s well worth

- Attorney’s costs

- Credit check costs

- Notary charges (when your condition means notarization)

- Recording costs

- Name look costs

You can also pay an enthusiastic origination commission which have either sorts of loan to cover cost of releasing and you may underwriting the mortgage.

A good credit score could help qualify for a decreased costs available. Minimal credit rating necessary for good HELOC against. a link financing can depend into the financial.

Carry out I want to initiate paying off a good HELOC or link financing at some point?

When your connection financing requires no monthly premiums, you can easily begin paying an effective HELOC in the course of time, but repayments usually are attention-simply for the initial ten years. HELOCs keeps an initial mark months the place you supply the line of credit. Brand new draw period for the majority of HELOCs try four to ten years.

Just like the draw months closes, you enter the payment phase. Fees have a tendency to expands to have 20 years since you build appeal and you may prominent costs.

Connection loan payment hinges on the regards to the mortgage arrangement. You could start that have minimal or interest-merely repayments, having you to definitely higher balloon commission owed at the conclusion of the fresh mortgage label. Your lender may additionally framework the mortgage no payments due until you offer our home, at which time you would afford the balance entirely.

Just how do repayment terms and conditions disagree anywhere between an excellent HELOC and you may a connection loan?

If you find yourself taking out a HELOC, you could have ten years to use it and another 20 to expend it well. You’ll be able to normally have the option in order to reduce make payment on prominent up to the brand new mark several months closes.

That have a bridge mortgage, you can or may well not generate monthly payments, depending on how the loan was organized. not, you really have a significantly smaller window in which to repay the latest loan. Bridge financing terminology appear to start around half a dozen so you’re able to 36 months in place of the brand new longer time period you only pay of a great HELOC.

Leave a Reply