- Penned to your

- step three minute read

Dena Landon was an author with well over ten years of expertise and it has got bylines are available in The brand new Washington Post, Spa, A Housekeeping and. A resident and you can a property trader herself, Dena’s bought and sold five property, worked when you look at the assets administration some other people, features authored more two hundred stuff toward a property.

Jedda Fernandez was a member rejuvenate publisher having HomeLight’s Resource Stores along with five years out-of editorial knowledge of the true estate community.

When you’re putting into action trying to find land, you’re probably longing for more space, a big garden, otherwise a storage rather than lower mortgage rates of interest. Loghill Village loans But failing woefully to score preapproved just before family shopping may cause heartbreak. Exactly what are the difference between pre recognition against pre qualified regarding mortgages?

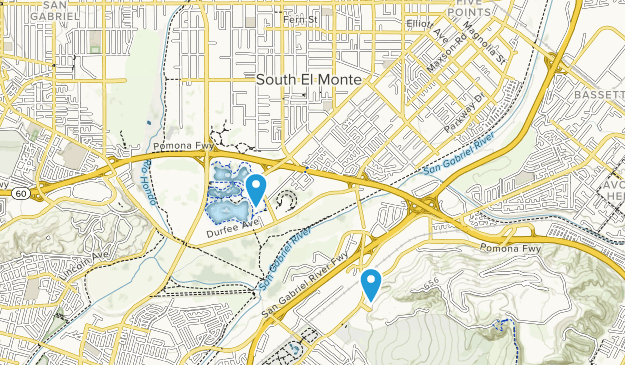

HomeLight normally hook up your which have a high agent common toward mortgage application process and you may domestic posts towards you. We familiarize yourself with more than 27 mil deals and you may thousands of evaluations so you’re able to decide which agent is best for your centered on your needs.

Marcus Rittman, manager away from mortgage businesses from the HomeLight, has seen that the latest catalyst for most people seeking to get recognized to own a good home loan is actually selecting a house which they love. The problem is, when they have not been preapproved, they are scrambling to get recognized and certainly will lose out on a property whilst needs time to work.

Do not let that end up being your! This is what you need to know on pre recognition vs. pre accredited versus. underwritten preapproval and that means you understand which you want before travel the first domestic.

Why do you need to dive as a result of these hoops?

Chris Austin, a skilled representative from the Kansas Town, Missouri, urban area, warns that if you initiate household hunting without having to be preapproved, You are growing a preferences getting something you can not afford – or even you can afford more do you think. A good preapproval can help you expose your home looking budget.

Extremely real estate professionals won’t manage people until they’ve spoke so you’re able to a loan provider, so they possess an obvious idea of what you are able afford. Sellers and additionally prefer has the benefit of regarding preapproved buyers because the there can be shorter exposure to them that the provide will fall as a consequence of. The fresh new long plus the short of it: Bringing preapproved makes it possible to vie from the housing marketplace.

If you want to buy a house, the lender otherwise lender should recognize how much currency you will be making as well as how much loans you have got. There are a few various methods one lenders will do so it prior to you may be in reality applying for a mortgage, and some are more robust than the others. Let’s take a look at differences when considering pre acceptance against pre certified compared to underwritten pre recognition.

Prequalification

When you start the newest prequalification techniques, you can easily share your revenue and you may expense with mortgage brokers – in many cases, they will not cost you verification.

To get prequalified for an interest rate, you just must state information, maybe not prove they. Rittman states which you yourself can share your income, loans, and readily available down-payment.

Predicated on one to, according to him, the fresh new expertise will saliva away several and you will say what you are prequalified to possess. But nothing could have been confirmed.

Lenders will most likely also look at the credit score and rehearse they, while the advice your reveal, to give an effective ballpark amount based on how much money your can also be use. Taking prequalified is one way to assess your finances – but most providers are not likely to take on an offer considering an effective prequalification; it is far from airtight sufficient. Predicated on Rittman, it’s better made use of because the a rule.

Preapproval

A good preapproval may be one step right up away from an excellent prequalification (even if sometimes these terminology are utilized interchangeably, that’s difficult). Including filling in many a credit card applicatoin and revealing earnings, you can be asked to share with you specific records along with your home loan lender(s) to help confirm simply how much income you have got as well as your personal debt load.

- 2 years regarding taxation statements

- W-2s and you will 1099s (to have self-employed money)

- Shell out stubs

- Profit-and-loss comments to have mind-functioning somebody

- Emails away from need to own holes into the employment

- Evidence of other forms of cash (a house, child assistance, alimony, and stuff like that)

- Source of the brand new down-payment finance

The lending company might demand extra files when you have special things, like a last foreclosures or bankruptcy proceeding. Everything the lending company requests for helps them ensure everything you’ve given all of them concerning your property and you may expenses.

A beneficial preapproval is generally thought a great conditional commitment to provide, however your last financing acceptance nonetheless will depend on the brand new successful completion of your full underwriting processes. In the place of a beneficial prequalification, since it is at the very least partially verified, it has to has actually a certain borrowing limit and can even are facts about their interest and you may terms and conditions.

When you create a deal that is accepted – which is more likely which have a great preapproval than just that have an excellent prequalification – and you give a valid pick contract, the lender will then finish the underwriting process to obvious your own loan to close.

Leave a Reply